Microsoft Dynamics 365 General Ledger-Fiscal Year Closing

Fiscal Year Closing:

Before closing a Fiscal year there are three certain configurations you need to pay attention to:

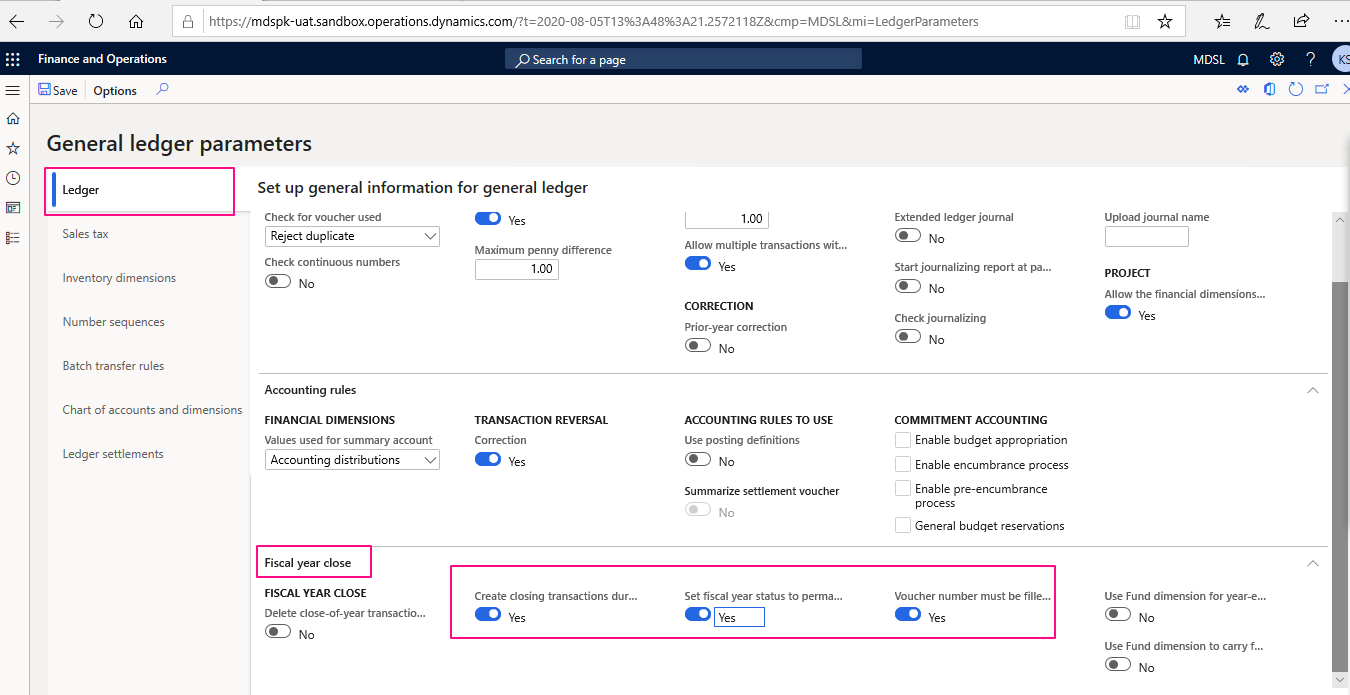

1. Delete close-of-year transactions during transfer; you want this selected to Yes as it will delete the opening transactions if you decided to rerun the fiscal year close process

2. Set fiscal year status to permanently closed; this should absolutely be set to No as it would close all the periods in your prior fiscal year, which would prevent you from making any transactions in those periods again

3. Voucher number must be filled in; it is considered best practice to set this to Yes so you can recognize the opening transactions in your trial balance with greater ease

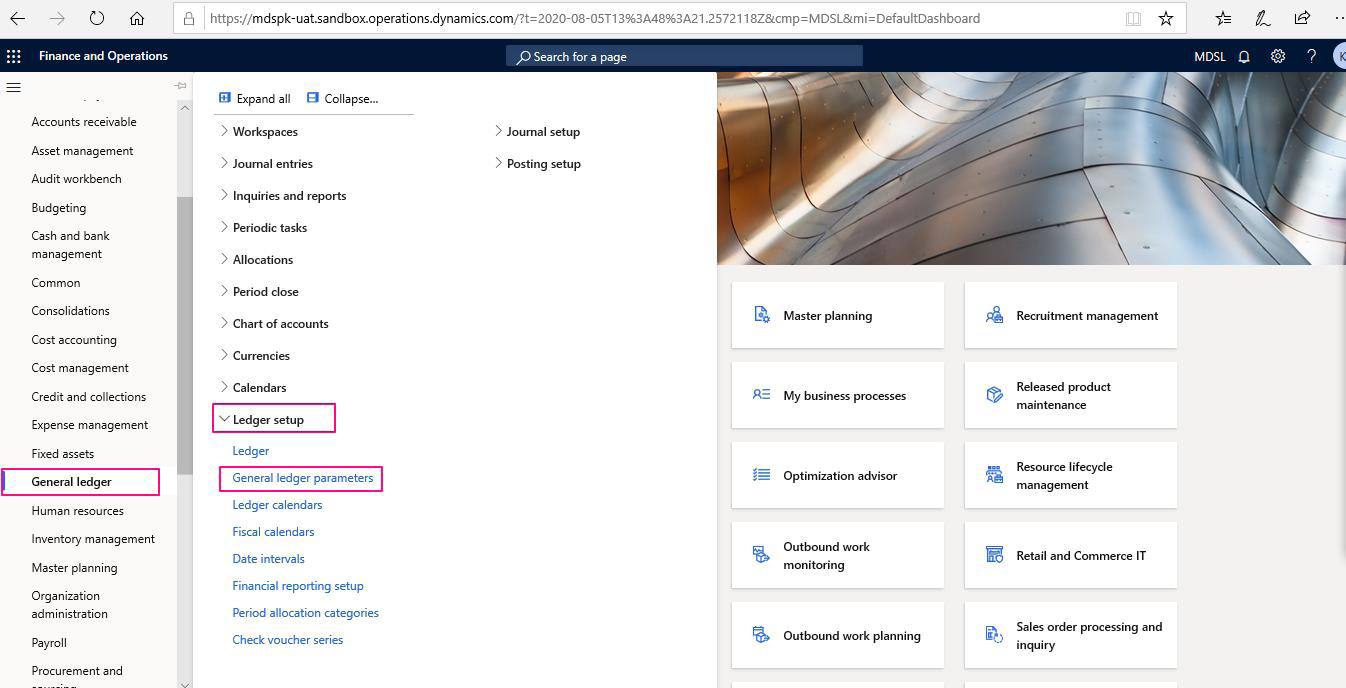

To setup General Ledger parameters, Go to>General Ledger>Ledger Setup>General Ledger Parameters

Open the Ledger Parameters and turn on the highlighted options.

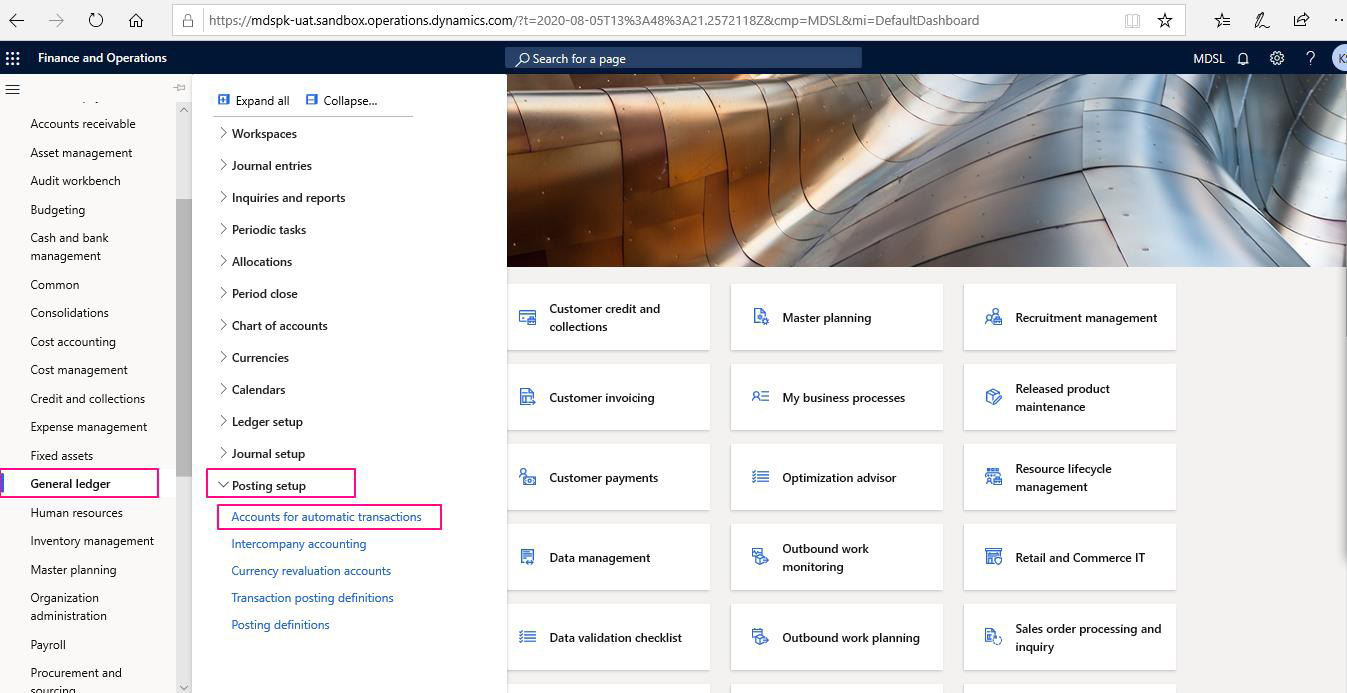

Once GL parameters are configured, go to General ledger> Posting Setup>Accounts for Automatic Transactions.

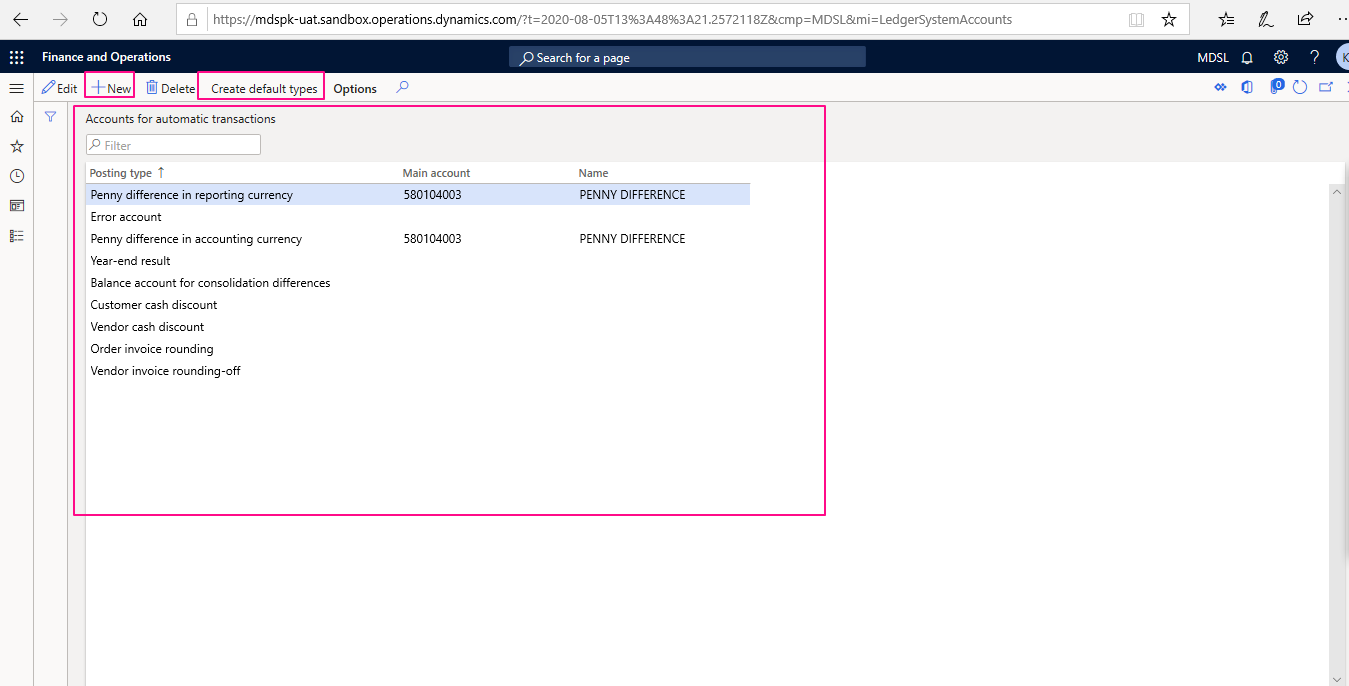

Open Accounts for automatic transactions and define all accounts by creating New. User may define all default account types. Make sure to have an automatic posting account for “Year end Result”.

Assign main accounts to all types and then close the form

Create a New fiscal year in fiscal calendar to carry forward all necessary main account balances.

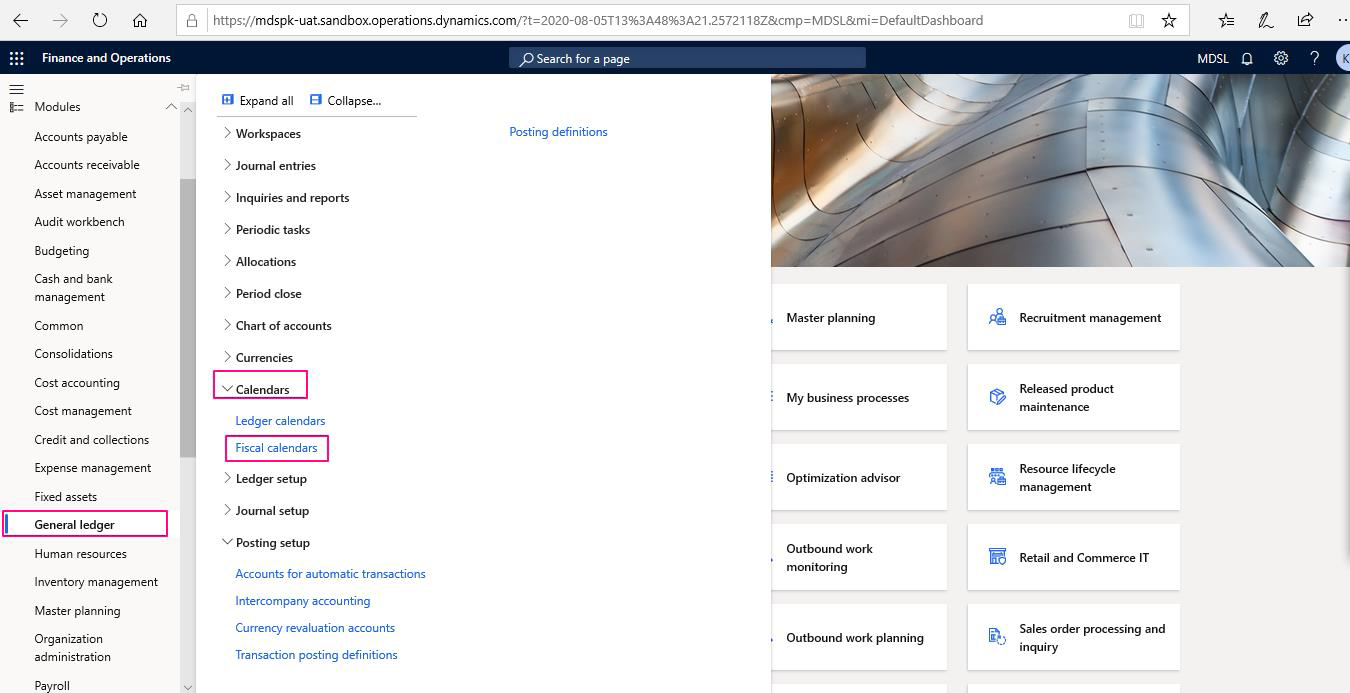

To create a new Fiscal year, Go to>General Ledger>Calendars>Fiscal Calendars

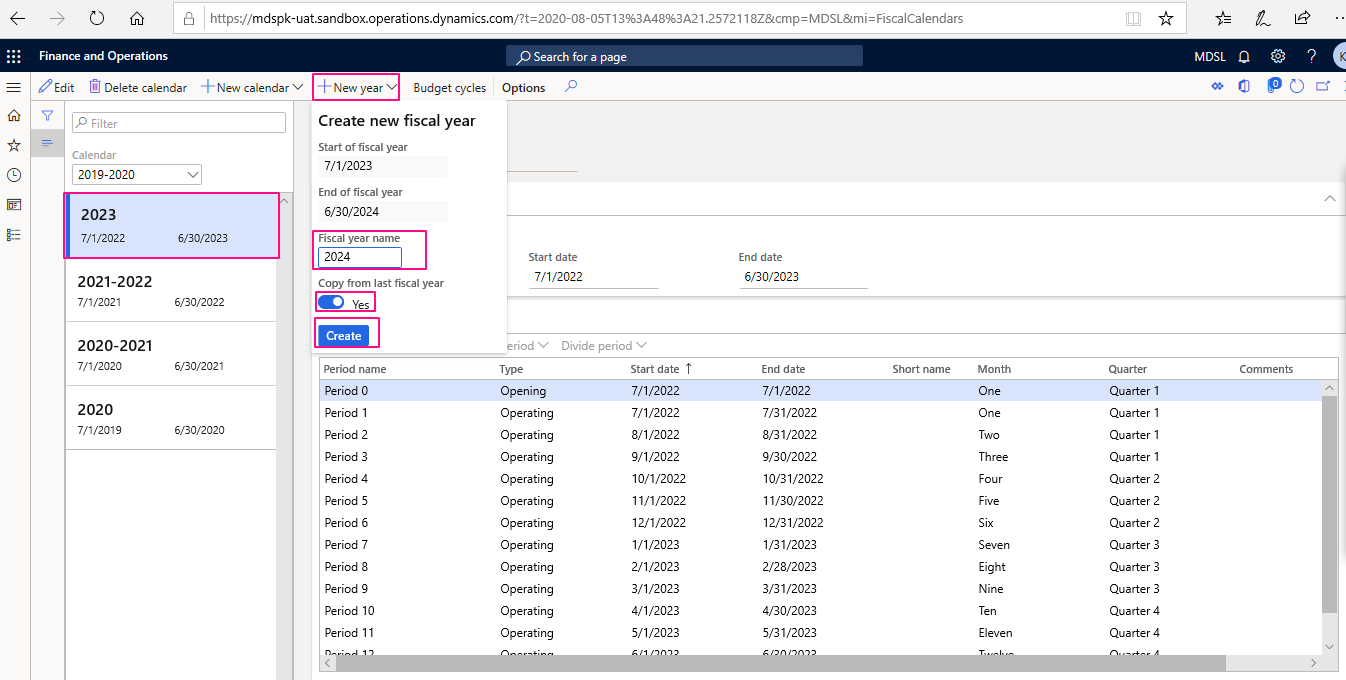

Choose a Fiscal Calendar and then click on “Create New Year”. Enter new year name and period information. Specify copy function in order to copy previous year period intervals. At the end click “Create”. It will create a new Fiscal year within a Fiscal Calendar

Tags In

Related Posts

Leave a Reply Cancel reply

You must be logged in to post a comment.

Categories

- Advanced Warehouse Management (4)

- Expense Management Process (1)

- Free In Person Trainings (2)

- Free Microsoft Training Videos on YouTube (19)

- Intensive Microsoft Bootcamps: Learn Fast, Learn Smart (10)

- Inventory Management (1)

- Life Cycle Services (1)

- Microsoft D365 Security (1)

- Microsoft Dynamics 365 Finance and Operations (20)

- Microsoft Dynamics Finance (28)

- Microsoft Dynamics HR & Payroll (4)

- Microsoft Dynamics Retail & Commerce (2)

- Microsoft Dynamics Supply Chain Management (23)

- Uncategorized (2)