Microsoft Dynamics 365 Cash & Bank Management – Bank Account Reconciliation

Bank Account Reconciliation:

When you receive a bank statement, you should periodically reconcile legal entity bank transactions with the transactions on the bank statement.

You cannot reconcile a bank statement with a bank account if any of the checks or deposit slip payments that are listed on the statement currently have a status of Pending cancellation. After a reviewer posts or rejects a check reversal or deposit slip payment cancellation, the status is no longer Pending cancellation, and you can reconcile the bank account

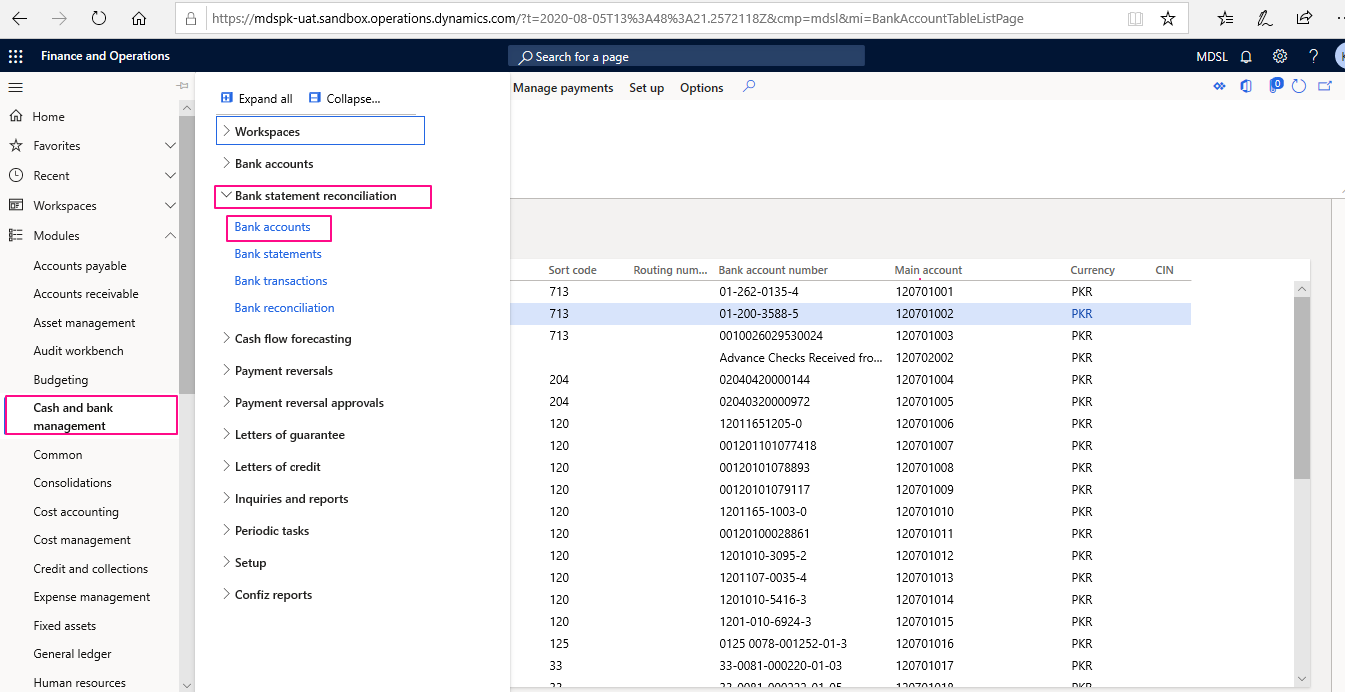

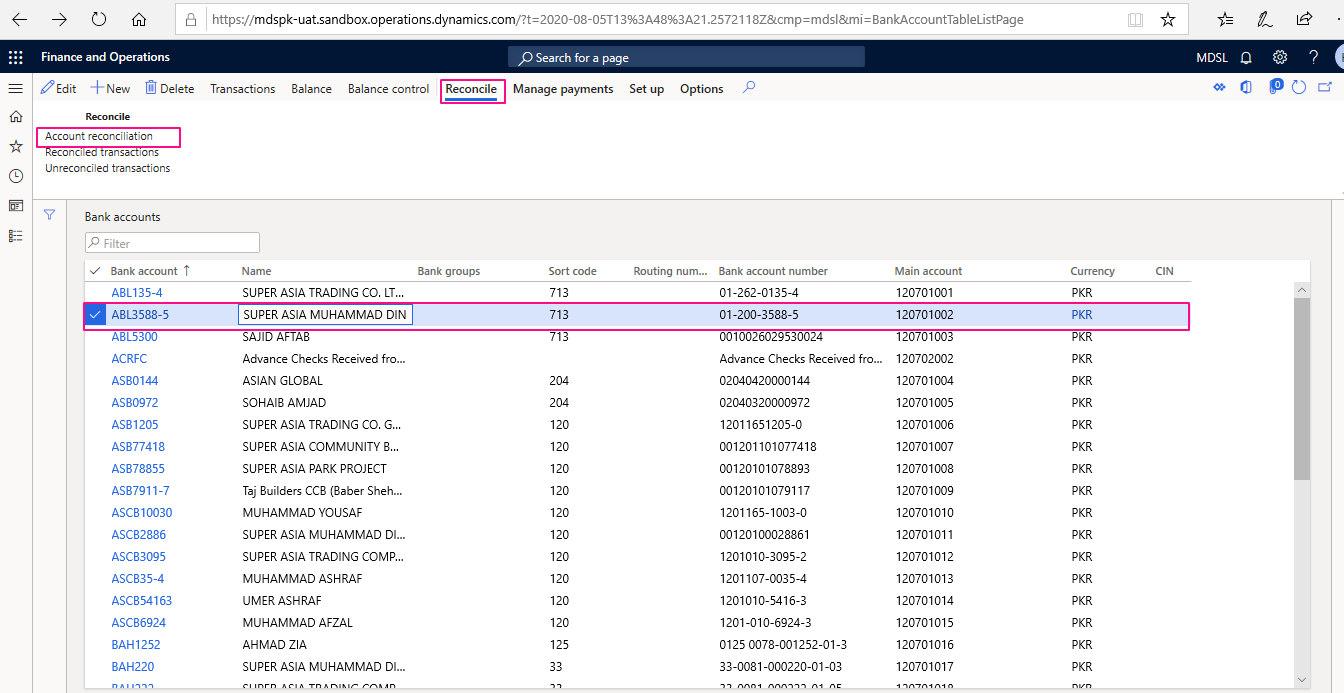

To reconcile a Bank Account, Go to>Cash & Bank Management>Bank Accounts>Bank Accounts

Open Bank accounts and choose a bank, Access reconcile function from header and open Account Reconciliation.

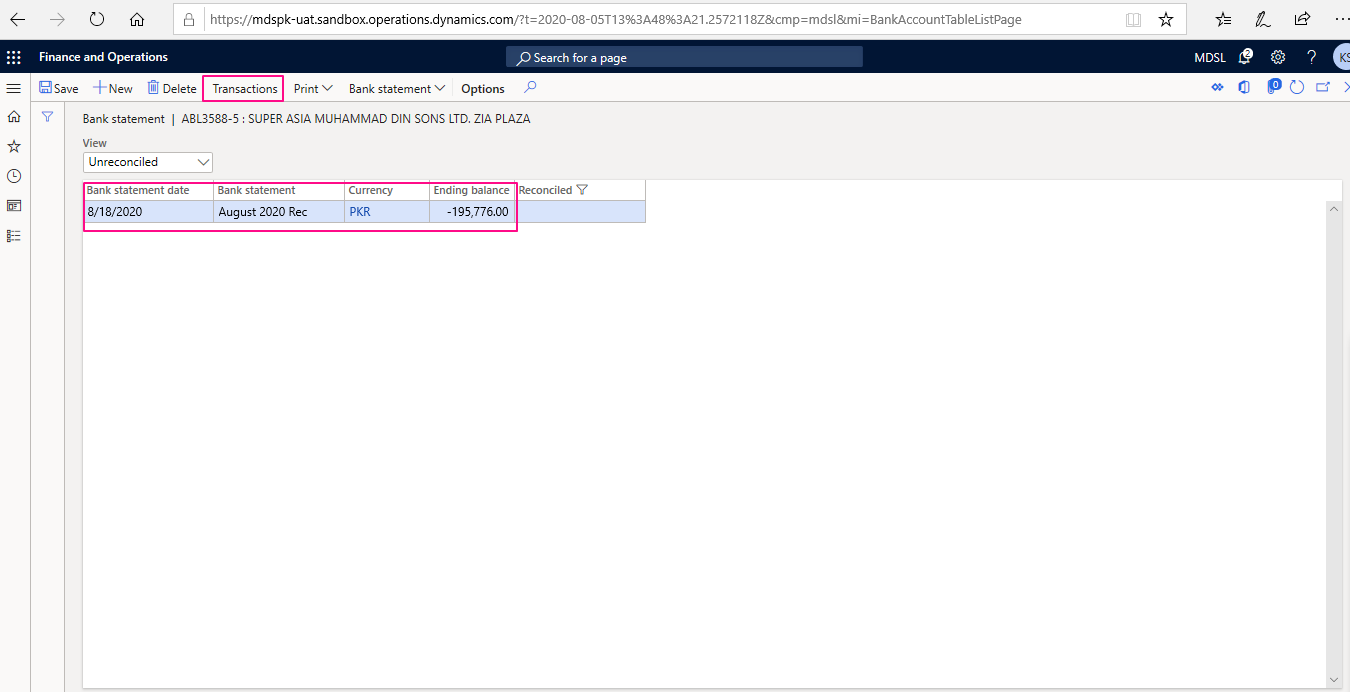

Enter the Bank Statement Date, Name and Ending Balance, Open transactions from header.

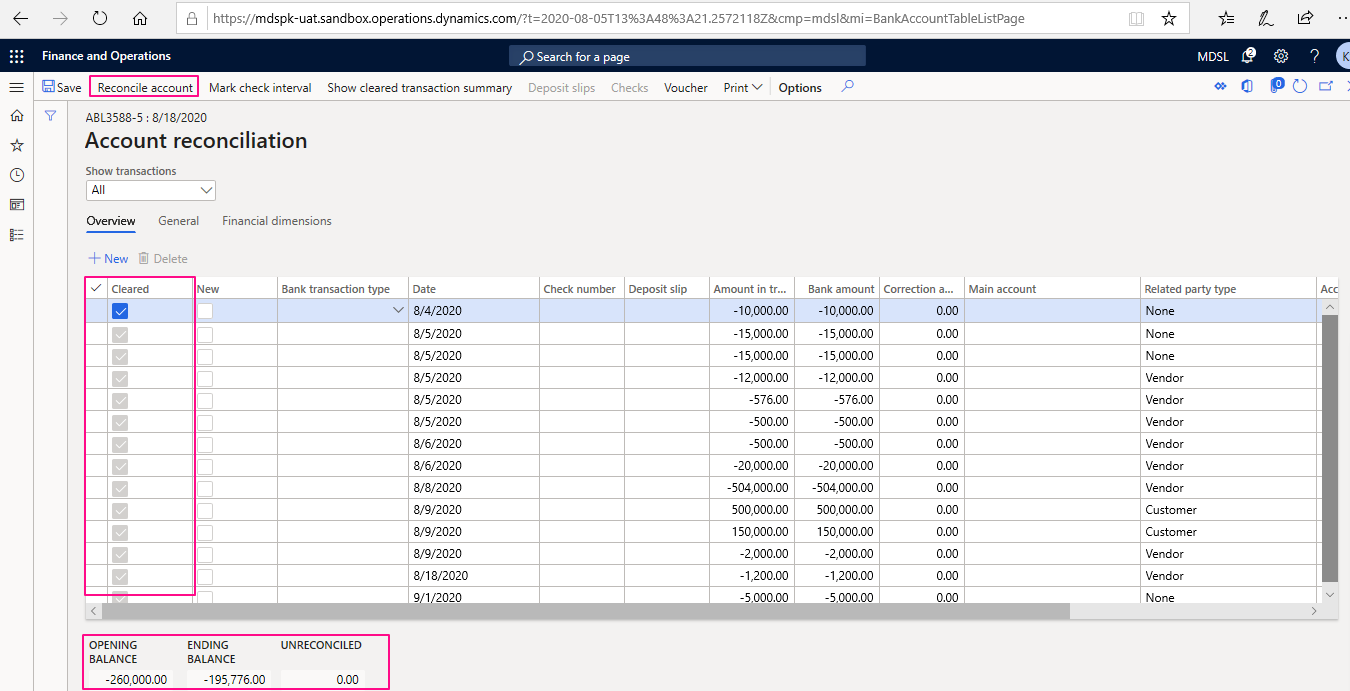

Match all the statement transactions with the system recorded entries, Mark every matching transaction as cleared. Perform the same function for all relevant entries. The unreconciled balance must be equal to Zero to enable “Reconcile account” header function. Any fees or charges by the bank are recorded additionally by clicking new and then enter the transaction details.

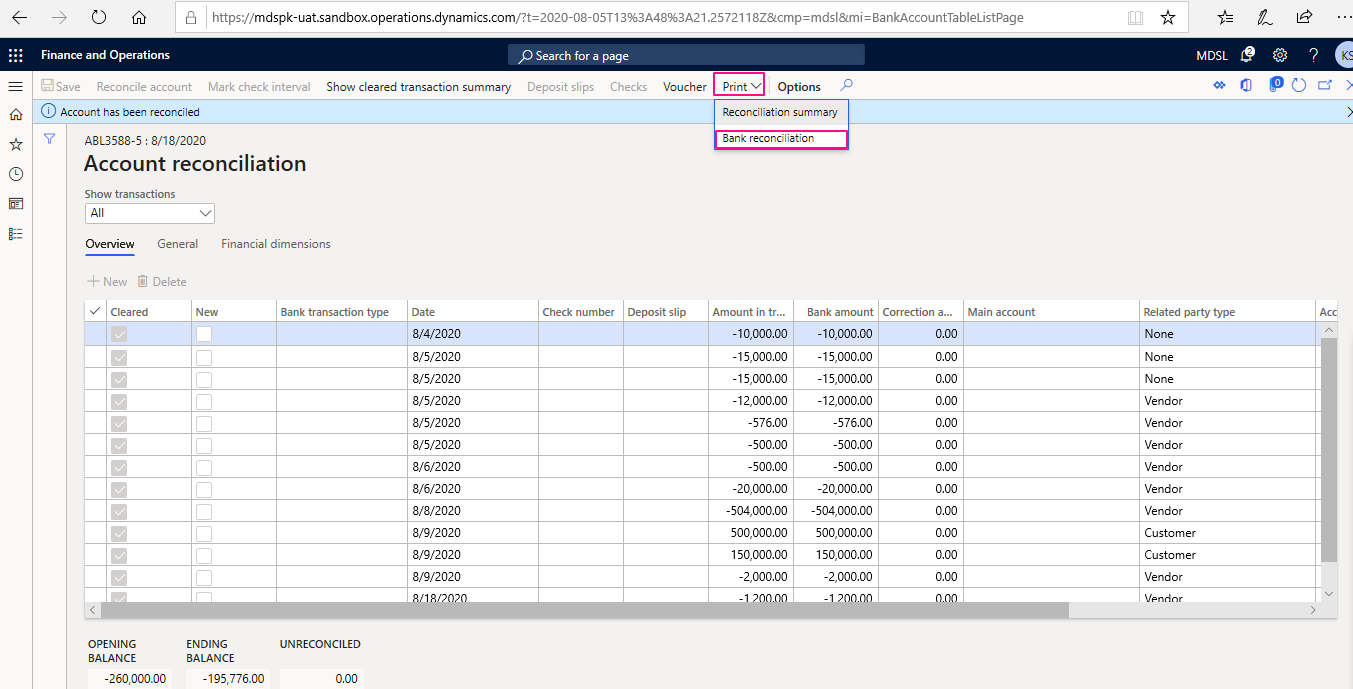

Reconcile account and print Bank reconciliation from header print function.

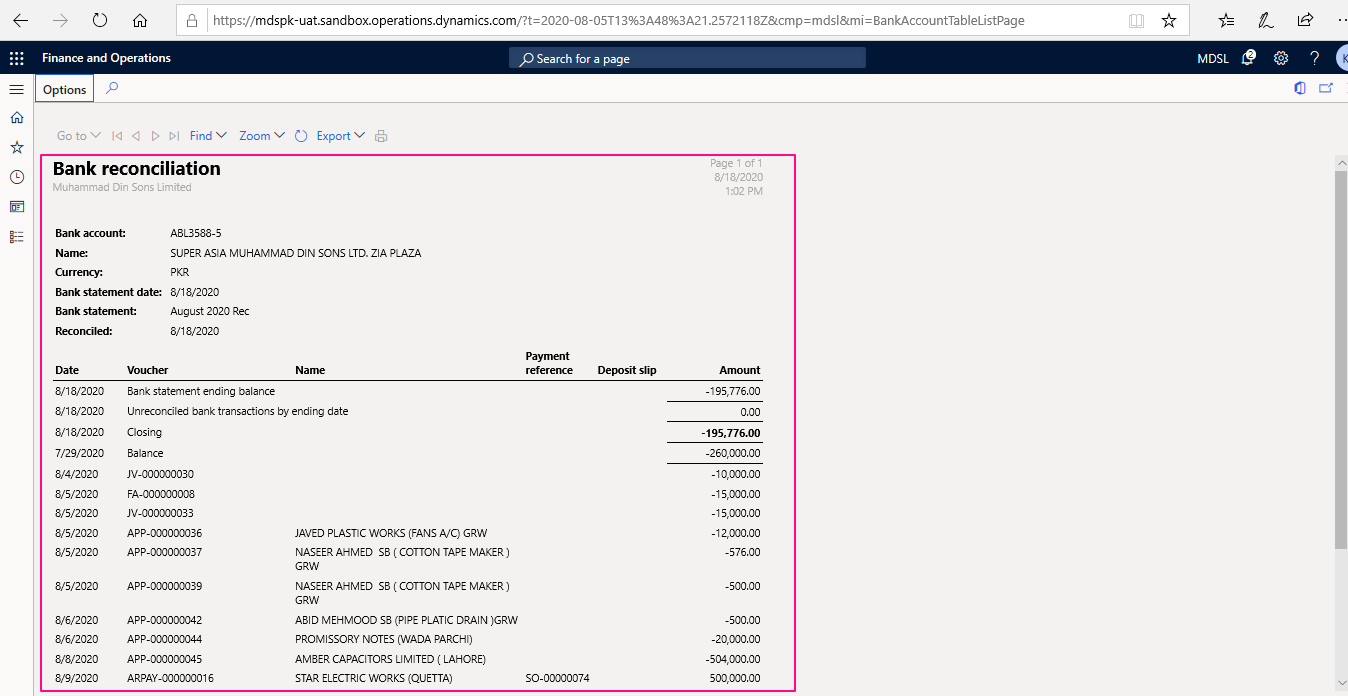

It will generate a Bank Reconciliation report as shown below.

Tags In

Related Posts

Leave a Reply Cancel reply

You must be logged in to post a comment.

Categories

- Advanced Warehouse Management (4)

- Expense Management Process (1)

- Free In Person Trainings (2)

- Free Microsoft Training Videos on YouTube (19)

- Intensive Microsoft Bootcamps: Learn Fast, Learn Smart (10)

- Inventory Management (1)

- Life Cycle Services (1)

- Microsoft D365 Security (1)

- Microsoft Dynamics 365 Finance and Operations (20)

- Microsoft Dynamics Finance (28)

- Microsoft Dynamics HR & Payroll (4)

- Microsoft Dynamics Retail & Commerce (2)

- Microsoft Dynamics Supply Chain Management (23)

- Uncategorized (2)